If your local rankings suddenly shrank and your heat map looks tighter than usual, you’re not imagining things. Over the past few weeks, we’ve seen a consistent pattern across multiple industries and locations: local search visibility is narrowing, and engagement metrics (views, clicks, etc.) are dropping. It's not just your business. This is happening everywhere.

Google Just Changed Local Rankings (Again): Here’s What You Need to Know

Is email marketing still effective for vacation rental companies? Absolutely! But if you’re email database isn’t growing, or you’re struggling to convert awareness to action, or you’re not getting enough direct bookings, you could be making these email marketing mistakes:

Top 4 Mistakes Vacation Rental Companies Make with Email Marketing

Google is no longer just a list of links. It’s a curated answer engine, and that shift impacts everything: SEO is now about visibility and site health, GEO is about getting your brand cited in AI-generated summaries, and GSO is about optimizing content to appear directly in generative search outputs like AI Overviews and AI Mode. And the brands being cited in AI summaries are winning visibility without even being clicked.

Your Customers Are Still Searching. But the Rules Have Changed.

If you’re doing all the digital marketing for a pharmacy yourself, you’re probably wondering if you’re doing it right. Or perhaps what once worked in the past is no longer getting you the results you want; that means you need to adjust your marketing methods! Whether you’re just starting out or want to elevate your business, here are a few of the most critical things to know about digital marketing for independent pharmacies:

4 Things to Know About Digital Marketing for Independent Pharmacies

Want to know how to market a vacation rental property? Whether you have a small vacation rental company or a larger operation, you need a smart marketing strategy! Read on to discover some of the worst things you can do in vacation rental marketing and what you should do instead:

3 Best & Worst Things to Do for Vacation Rental Marketing

User-friendly website platforms like Squarespace and Wix make it easy for small businesses to create a cheap website, but is it actually costing you more than it's helping? Find out why these small business website builders aren’t really that good for SEO, why it matters, and how we can help grow your business with the best small business website design services:

Why Most Small Business Website Builders Are Bad for SEO

Every small business owner knows that having an online presence is essential, but having a website and social media is just the tip of the iceberg when it comes to an effective marketing strategy. Strong search engine optimization should be an ongoing priority for growing your business, and even small mistakes can make a big impact. Want to know how to improve SEO for your small business? Avoid these common SEO mistakes:

4 Common SEO Mistakes Small Businesses Make and What to Do Instead

Google has quietly updated its official URL structure guidelines, and while the principles of clean, crawlable URLs remain the same, the latest version brings new clarity, stricter encoding expectations, and important changes for SEO-conscious businesses.

Google Just Updated Its URL Structure Guidelines - Here's What It Means for Your SEO

OpenAI just launched a major upgrade to ChatGPT Search, and it has big implications for how customers discover businesses online. This isn’t just another tech update. It’s a signal that AI-first search is here, and your current SEO strategy may no longer be enough.

AI Just Changed Search Again. Are You Still Visible?

SEO professionals have fought for years to prove their impact. We’ve built dashboards, reported wins, and connected content to conversions. But in 2025, the attribution model has broken down. AI search has reshaped the user journey, clicks are disappearing, and traditional analytics tools can’t keep up.

SEO Attribution in 2025: Why It Broke and How Growth-Minded Brands Should Respond

At IMEG, clients often ask: “With AI dominating search, does SEO still matter?” A new study analyzing 25,000 searches across ChatGPT, Google’s AI Overviews, and Perplexity gives a clear answer: Yes. SEO is still essential.

Is SEO Still Worth It in the Age of AI? Absolutely. Here’s the Proof.

Google just fixed a bug that misclassified AI Mode search traffic in Google Analytics. Instead of being labeled as "organic," it showed up as "direct." For marketers and agencies who rely on accurate data to drive decisions, this bug could have distorted performance insights for several days.

Google AI Mode Traffic Bug: What It Means for Your Marketing Reports

As Google continues to evolve how users experience search through AI, a key update was just confirmed that directly impacts your ad visibility and how we manage your campaigns.

Google Ads Just Changed — Here’s What It Means for Your Campaigns

Over 1.5 billion users now interact with AI Overviews each month. If your current search strategy still revolves around keywords and old-school placements, you are already falling behind.

AI Search Now Performs Like Traditional Google Ads — Here's What That Means for Your Business

Google has confirmed that AI Mode performance data is coming to Search Console, but with a key limitation: You won’t be able to break it out separately from traditional search or AI Overviews.

Google Search Console Will Report AI Mode Performance — But You Still Won’t See the Full Picture

At this year’s Google Marketing Live 2025 (Wednesday, May 21, 2025), Google unveiled a sweeping set of AI-driven changes that are reshaping everything from how people search to how your ads appear and convert. As your marketing partner, we’re already implementing the most impactful updates to make sure you stay ahead—on Google, YouTube, and beyond.

Google Marketing Live 2025: What It Means for Your Business (And Why You Should Care)

Over the last decade, Sevier County Tennessee — home to Gatlinburg, Pigeon Forge, and Sevierville — has become one of the top-performing vacation rental markets in the United States. Fueled by tourism, short-term rental adoption, and rising investor interest, the region has delivered exceptional ROI for owners. This report breaks down what changed between 2015 and 2025 and what investors need to know going forward.

Sevier County Vacation Rental Market Trends (2015 to 2025)

In May 2025, Google made a major change to how GA4 sets browser cookies. There was no announcement, no documentation, and no warning. For marketers and developers who rely on tracking client IDs, session attribution, or server-side data pipelines, this update may already be disrupting data collection without anyone realizing it.

Google Quietly Changed the GA4 Cookie Format. Here’s Why It Matters to Your Marketing Data

At IMEG, our mission is to keep clients informed and ahead of the curve—and Google just released an update that every food and drink business needs to know about.

How Restaurants Can Use Google’s New “What’s Happening” Feature to Attract More Customers GA4 Just Killed the Old Key Events Report — Here’s Why That Matters (And What to Do)

GA4 Just Killed the Old Key Events Report — Here’s Why That Matters (And What to Do)

There are millions of businesses throughout the world and it would be far from the truth if we told you we could grow all of them with Facebook strategies.

How Investing $1,000,000 With Facebook Grew Our Clients’ Businesses

“I tend to approach things from a physics framework. And physics teaches you to reason from first principles rather than analogy.” – Elon Musk

How to Grow Your Email Database by Over 40,000 Emails in 14 Days

Have you started a blog for your website and need help getting more page views? We recommend adding audio to your blog! Oftentimes, people don’t want to take the time to sit and read a lengthy blog. Most will skim it to read the main points and section headings, but very few take it in word for word. Audio makes it easy for users to just press play and hear your blog read to them as they’re on the go! If you need more convincing, take a look at these 7 reasons why you need audio for your blog:

7 Reasons Why You Need Audio for Your Blog

Social media marketing is a vital part of an effective marketing campaign. Many, if not all, of your consumers have some form of social media. You wouldn’t want to miss out on the chance to reach millions through social media efforts! At IMEG, we believe that having a successful social media strategy is a major key to growing your business. Learn more about the evolution of the social web below:

Social Web Evolution, Revolution, Contribution – IMEG Social Media Marketing

As you probably already know, PPC stands for pay-per-click. In general, this type of advertising is a way to buy visits to your site by paying each time your ad is clicked. The most important parts of creating this kind of campaign are setting up your PPC campaigns, knowing which keywords are best, how to build emotion in your ads, and knowing how to monitor and track your PPC efforts so you can be sure to make the most of your campaign. We have had years of experience with PPC advertising, especially in the Smoky Mountain market, and here are a few of the most common PPC mistakes we’ve seen:

6 PPC Mistakes You’re Probably Making

Have you noticed a change in reach for your Facebook page? You may have noticed the number was a little crazy on the positive side for most people. IMEG would like to take a moment to explain why these numbers may have changed for you! Find out more about Facebook reach and how you can increase your page’s reach.

Facebook Changes Reach Metric

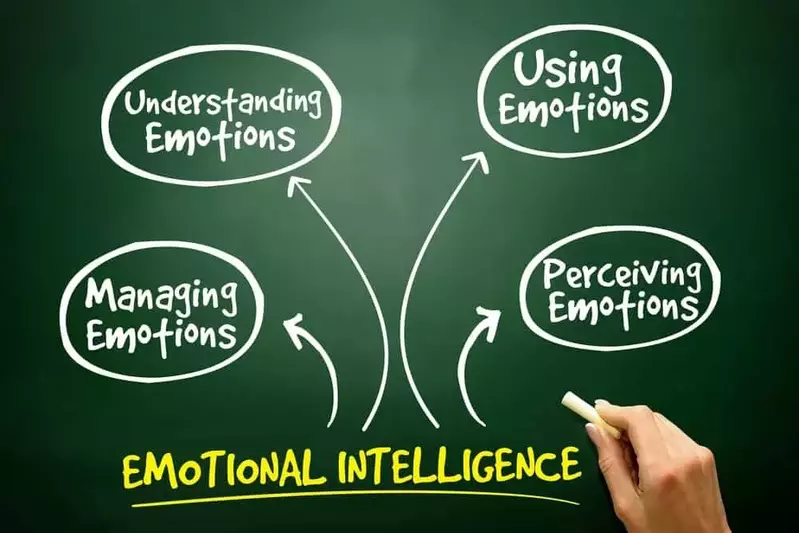

What role do emotions make in your decisions? If you’re like most people, emotions matter when it comes to decision making. Few people make decisions by thinking logically first. Most of the time, decisions are made from an instinct or emotional reaction, followed by logical reasons why the decision was made. If you plan your marketing strategy right, you can make an emotional connection with your audience, influencing a decision and causing people to act. Keep reading to learn more about making an emotional connection through marketing:

Making an Emotional Connection Through Marketing

It doesn’t take much math to realize that direct bookings are more profitable and a much more sustainable approach to running your business in the vacation rental industry, and we want to help you increase your direct bookings in the Emerald Coast Market.

How to Increase Direct Bookings in the Emerald Coast Market

Since February 2000, TripAdvisor has grown at an astonishing rate. Now, the world’s largest travel site brings in over 170 million reviews related to hotels, vacation rentals, attractions, and restaurants. Averaging nearly 280 million unique visitors each month, it’s safe to say a brand’s presence on the site is comparable to the importance of the way you dress for a job interview.

How to Increase Your TripAdvisor Ranking

As the age old question has been asked for many years, would you rather have $1,000,000 today or a penny doubled every day for 30 days? If you’re in business, you know that the more sustainable and lucrative model is to take the compounding interest return of a penny doubled every day. Unfortunately, we don’t always see this approach in businesses today as many businesses want it all now with instant gratification.

Warren Buffett’s Strategy Is Proven To Pay Off Long Term

Almost 10 years ago, Sevier County’s Tourism Committee requested for companies interested in becoming the new marketing agency to promote the <a href="https://www.visitmysmokies.com" target="_blank">Visit My Smokies website</a> to submit their qualifications. Four companies responded to the request, including our company. Both IMEG and Texas-based U.S. Destination Marketing (USDM) were invited back for another round of interviews. IMEG won the bid against USDM and has been partnered with the county to market Visit My Smokies since late August 2012.

IMEG takes on Sevier County marketing campaign www.visitmysmokies.com in 2012

A site widget is a component that is added to a website to improve functionality. These widgets are actually a small part of a different website within another website, similar to an iframe. We want to share with you what you need to know about widgets, how they affect your website, and their effect on SEO for your website. Keep reading to learn more about site widgets:

What You Need to Know About Site Widgets and SEO

Since Facebook introduced Promoted Posts for business pages, many page owners have taken advantage of a way to push content to more people than would usually see your content. Still, other people have been angry, believing that Facebook was sending their posts to Cyber-Siberia and would only let them see the light of day if payment was made. The roll-out for Promoted Posts for personal pages has only confused things more.

Facebook Promoted Posts: What They Are and What They Aren’t

How do you know when it’s time to stop doing all of the marketing work yourself and hire a marketing agency? Chances are, a marketing agency could really benefit you as you continue to grow your business. At IMEG, we specialize in digital marketing and know how to maximize your marketing to hit the goals you want for your business. If you’re still unsure about hiring a marketing agency, go through these questions below:

Why Should You Hire a Marketing Agency?

As we know, guests want to book with the company who provides them with the best deals and best experience. Hotels want guests to book direct to save them the hindering of 15% to 25% they are paying OTAs. What if there is a way to give each side what they value and also build relationships that produce a winner’s exchange? OTAs have the leverage with their deep pockets that allow them to market at a scale that 99% of independent hotels can not.

Learn More About A Proven Way To Lower OTA Fees

Reputation is one of the most vital variables to success in the travel and tourism industry. Hotel brands that understand the importance of what their guests are saying about them have shifted to using custom-built tools to handle the volume of reviews that are written across the internet on sites like Expedia, TripAdvisor, Google, Booking.com, Orbitz and many more. Learn more about how you can manager your online reputation to ear more revenue!

How to Manage Your Online Reputation for Higher Revenue

Since its infancy, Facebook has had one core objective, and that is to connect people. As we all know, they have achieved this goal, and better yet, this social media platform has connected the majority of the world. Facebook has billions of users actively on their social media app. To efficiently serve billions of people, there will always be change. Period. Just think about a business that serves 100,000 people. Tons of change occurs in learning and becoming better at serving those people to add value and keep them coming back. Whether it be <a href="/blog/facebook-admits-to-data-errors-on-pages">bug fixes</a> or general improvements for users, Facebook, like any business, is making changes daily to build their platform better than it was yesterday and most importantly be a place for you, the user, to spend more time. Learn about how these changes affect your business:

Your Business and Facebook Changes

Legendary physicist Albert Einstein is attributed to saying that compounding interest is both “the greatest invention in human history” and “the most powerful force in the universe.” While Einstein’s sentiments may have been intended as financial advice, IMEG believes these famous remarks can provide important insights for today’s internet marketers and competitive webmasters as well.

Is Compounding the key to a high ROI? IMEG tells all! – IMEG Social Media Marketing & SEO

Starting in September of 2013, IMEG and many other Facebook page administrators noted that page reach seemed to be trending sharply downward. After several months, Facebook has admitted that its data on page reach and impressions has been flawed since September of 2013. This was because Facebook was updating its mobile apps for iPhone and Android to make them run faster, and as a consequence, sent only enough data to the mobile apps to make them display the newsfeed correctly. We’ve gathered all the details about Facebook’s data errors and if the problems have been fixed.

Facebook Admits to Data Errors on Pages

Many tools exist that allow a busy business owner to pre-schedule their social media messages on Facebook, Twitter, Instagram, blogs and Pinterest. These tools can save time and effort, as well as target your message to the right audience at the right time. Maybe you need to start a special at a certain time but you can’t be online to start it. The ability to pre-schedule those posts can indeed be a life-saver for a busy business owner. Facebook allows pre-scheduling (and back-dating) right on your Page. Tools such as Hootsuite and Ninja Pinner allow Twitter, Pinterest and LinkedIn posts to be scheduled ahead of time. Learn more about marketing automation below:

When Marketing Automation Goes Wrong

What is the main difference in marketing cost and the cost of using OTAs from a hotelier’s perspective? IMEG client data shows there is a 10% – 15% difference in the cost to generate an online booking with marketing strategies versus using a OTA. The average OTA fee to generate a online reservation is between 18% – 25% depending on your relationship with the OTA.

What is the Difference Between Marketing Cost and the Cost of Using OTAs?

Are link wheels considered Black Hat? That’s a question we’ve been hearing circling around. The first question we should answer, however, is, “What are link wheels?” We answer all that and more below!

Should You Still Be Using Link Wheels?

We believe more clarity and updates in regards to guidelines and restrictions will be released between Monday, April 27 and Tuesday, April 28, 2020 by local and state officials. This will help our industry make clear, concise decisions for our businesses and tourists during the <a href="/blog">coronavirus</a>.

Are Sevier County Businesses Opening May 1, 2020?

Below is a list of the top indicators to watch to determine when the tourism market will come back post <a href="/blog">COVID-19</a>.

Indicators the Tourism Market is Coming Back Post COVID-19

Below are what we predict will be the top shifts in travel and tourism market.

6 Core Shifts in Travel Behavior Post COVID-19

On April 13, 2020 we held a live webinar where we updated the Smoky Mountain market on the changes in travel and tourism since the COVID-19 outbreak. In this live webinar, we will give updates on the Smoky Mountain area including Pigeon Forge, Gatlinburg and Sevierville. We’ll be talking about what the data looks like in the marketplace as well as things you can do to help your business grow in times like these. We will discuss when we think the market is expected to come back and what it will look like when it does. We will also cover many tips and strategies to get the most out of the recovery.

Smoky Mountain Tourism Webinar Transcript & Replay / April 13, 2020

Like all things in life, change occurs. Marketing is one of them. In a good economy, it changes daily and in a challenging economy, it changes even faster. Marketing is one of the most powerful sources in the vacation rental industry to grow your business, but can also waste a lot of dollars if done wrong. Below are some strategies that will keep your vacation rentals top of mind with guests during and, most importantly, after the <a href="/blog">coronavirus pandemic</a>.

What Marketing Will Work for the Vacation Rental Industry After the Coronavirus Pandemic?

COVID-19 Vacation Rentals / Hospitality Industry Update April 10, 2020 – Major Changes In Merchant Accounts for Vacation Rentals. April 10, 2020 Updates on COVID-19 / Corona Virus updates for the Vacation Rentals / Hospitality industry from Micah Berg Founder & CEO of <a href="https://www.youtube.com/redirect?q=https%3A%2F%2Fwww.thevru.com%2F&redir_token=zutTd1eOX0oEmpaorHz-2QcD6UZ8MTU4NjY2MDIwNEAxNTg2NTczODA0&v=Wack5RLmQoE&event=video_description" target="_blank">https://www.thevru.com/</a> and Justin Jones Founder and CEO of <a href="https://www.youtube.com/redirect?q=https%3A%2F%2Fimegonline.com%2F&redir_token=zutTd1eOX0oEmpaorHz-2QcD6UZ8MTU4NjY2MDIwNEAxNTg2NTczODA0&v=Wack5RLmQoE&event=video_description" target="_blank">https://imegonline.com/</a> and Daniel Evans – Director of growth at IMEG.

COVID-19 Vacation Rentals / Hospitality Industry Update April 10, 2020 – Business Protection Plan

Below is an email I received from a member of IMEG’s board of directors, a man that knows so much about true business. This has so much value all the time but for sure right now when cash is so important to stay alive. If you do not follow Keith I highly advise you do so as he has been huge for our business from being a member of our board as well as just great training, books, and insights.

13-Week Cash Flow Forecast

Hello from your friends at IMEG. The tourism industry accounts for 10% of the world’s GDP and jobs.The World Travel and Tourism Council has warned the COVID-19 pandemic could cut 50 million jobs worldwide in the travel and tourism industry.

Navigating the Pandemic in Vacation Rentals

Today is April 7, 2020 and this is to help bring you a perspective for what to expect after the coronavirus in the travel and tourism industry. We know with proper social distancing and sanitary measures the Coronavirus begins to slow its growth and decline in cases. We also hope that the warming weather slows the spread as well, similar to the flu.

United States Destination Markets After The Coronavirus

A good review can gain your business a customer and a bad review can lose you 10 or more. This is true with owners as well. What we have to remember in our vacation rental businesses today is that people trust people not your company. Reviews are one of the top ways we have to promote our service in the most authentic way. If you follow any thriving brands in our industry, most of them have optimized their social proofing strategies to the point where they let their past guests build trust with future guests for them. This is where your marketing efforts can exceed the industry average.

Why Reviews Matter Most in Post Coronavirus in the Vacation Rental Industry

To start, I realize that we are operating our businesses in uncharted times, but the future does look promising. Over the last 2 weeks I have met with many businesses with the same question:

3 Reasons Why Marketing is Critical for Your Vacation Rental Business During COVID-19

March 28, 2020 Updates on COVID-19 / Corona Virus updates for the Vacation Rentals / Hospitality from Micah Berg Founder & CEO of real <a href="https://realjoy.com/" target="_blank">https://realjoy.com/</a> <a href="https://www.thevru.com/" target="_blank">https://www.thevru.com/</a> and Justin Jones Founder and CEO of <a href="/">https://imegonline.com</a> In this update we we talk about how to hand unemployment. You can get FREE access to <a href="https://www.thevru.com/" target="_blank">https://www.thevru.com/</a> by using discount code covid19 at checkout.

COVID-19 Vacation Rentals / Hospitality Industry Update March 28, 2020 – How to handle Unemployment

March 27, 2020 Updates on COVID-19 / Corona Virus updates for the Vacation Rentals / Hospitality from Micah Berg Founder & CEO of real <a href="https://realjoy.com/" target="_blank">https://realjoy.com/</a> <a href="https://www.thevru.com/" target="_blank">https://www.thevru.com/</a> and Justin Jones Founder and CEO of <a href="/">https://imegonline.com</a> In this update we we talk about how to hand PR. You can get FREE access to <a href="https://www.thevru.com/" target="_blank">https://www.thevru.com/</a> by using discount code covid19 at checkout.

March 27, 2020 Updates on COVID-19 / Corona Virus for the Vacation Rentals – How to handle PR

March 26, 2020 Updates on COVID-19 / Corona Virus updates for the Vacation Rentals / Hospitality from Micah Berg Founder & CEO of real <a href="https://realjoy.com/" target="_blank">https://realjoy.com/</a> <a href="https://www.thevru.com/" target="_blank">https://www.thevru.com/</a> and Justin Jones Founder and CEO of <a href="/">https://imegonline.com</a> In this update we we talk about how to save cash, get more cash flow, how to market in this pandemic, when might the travel and tourism industry turn around, and also what does the travel and tourism market look like when this pandemic is over, and more. You can get FREE access to <a href="https://www.thevru.com/" target="_blank">https://www.thevru.com/</a> by using discount code covid19 at checkout.

March 26, 2020 Updates on COVID-19 / Corona Virus for the Vacation Rentals / Hospitality Industry ( Video Included )

<a href="https://www.vrmintel.com/" target="_blank">VRM Intel</a> in Gatlinburg, TN – an all-day conference that brings together many of VRM Intel Magazine’s writers, industry thought leaders and local vacation rental managers.

VRM Intel Live! Gatlinburg 2020 Vacation Rental Conference

In this article, I am going to bring attention to exactly how you can begin converting those website visitors into actual paying customers.

Tips for Turning Website Visitors into Customers

We wrote this article to bring you and your vacation rental business value that will save you time, money and energy. Why? Because I want you to keep winning and growing your business! There is an epidemic going on throughout the vacation rental industry and it is getting harder and harder to watch so many businesses slowly decline in revenue and, even worse, go out of business or be forced to sell.

A Must Read Vacation Rental Industry Warning

How does your site stack up? What opportunities are you missing?

Is your website speed costing you money?

We are a business consultant agency that specializes in helping vacation rental businesses thrive and grow in their space.

Tips for Generating Direct Bookings for Your Vacation Rental Business

Site speed is important. In fact, seconds matter. Just 1 second of additional load time can impact your revenue from your website by XX%.

IMEG to Offer Website Hosting That is 40% Faster

<em>Sevierville, Tenn. – July 25, 2018 –</em> Internet Marketing Expert Group, Inc. (IMEG), a digital marketing agency based in Sevierville, TN, has been named to the 2018 Inc. 5000 List of fastest-growing private companies in America. This marks IMEG’s fifth consecutive year earning a spot on the list.

IMEG Named to 2018 Inc. 5000 List for 5th Year in a Row

ATTENTION, ATTENTION, ATTENTION. Where is attention these days at scale? SOCIAL MEDIA. Whether you get your daily dose on Instagram, Facebook, Snapchat, Twitter, etc. you are engaged and on screen multiple times a day commenting, liking and sharing content. When this happens, you are giving your attention to a media company. Let me go a step further to explain … we are all media companies. If you have a following of people who engage with your content on the regular, you are a media company. Though maybe small, you are a version of a media company.

What Do the Tourism Industry and Dwayne ‘The Rock’ Johnson Have in Common?

This is a question I have been asked lately and it’s a good one to understand when running a business that uses the internet to drive new and repeat business. Let’s get started.

What is the Difference Between Local SEO & Organic SEO?

We often forget, as business owners, that doing something extremely well does not make it important. It’s not until your efficiency becomes optimal that it truly becomes effective. Efficiency is the art of doing something well and, in business, being able to do it consistently, while effectiveness is the art of creating something useful and of value. After all, value is what your customer seeks on the daily.

Are You Marketing Your Business Efficiently, Effectively Or Both?

It’s always been about adding so much value to your customer that they can’t help but bring your business or product up in conversation with their friends and family. In today’s world, reviews are this and so much more.

Why Focusing on Reviews Today Will Build Your Business Tomorrow

<em>Sevierville, Tenn. – August 23, 2017 –</em> Local marketing agency, Internet Marketing Expert Group, Inc. (IMEG), has been named to the Inc. 5000 List of fastest growing private companies in America. For IMEG, this is the 4th consecutive year being ranked on the list.

IMEG Named to the 2017 Inc. 5000 List for 4th Consecutive Year

We all know email marketing is very powerful and used by most businesses as a solid marketing channel that increases sales and revenue. In marketing, we are always looking for the lowest acquisition costs to get in front of the right people. We commonly say we day trade attention.

This Tool Will Grow Your Business More Than Email Marketing – And It’s FREE

It’s 2017 and, if you haven’t noticed, everyone has a lifeline now. Yeah, that’s right, ask the person sitting next to you the one thing they have that they truly and honestly could not do without every day. Even my grandfather at 75 years old knows how to stream his favorite Merle Haggard tunes to his Bose Bluetooth speaker. He has even become an avid Amazon Prime member! For the technical-minded, he files under a Post-War Cohort. Yes, I thought only Baby Boomers, Generation X, Generation Y, Millennials and Generation Z were the ones who did everything from their mobile devices, but it’s literally the entire human race.

Are You Marketing In The Year Your Business Lives In?

It’s no secret that the majority of the traffic that lands on your site are potential customers. Only a small percentage of that traffic is irrelevant or unqualified. So, to focus on the 95% of people coming to your site, what are you doing now to increase conversion and traffic?

Why is Website Traffic Growth Important?

Digital marketing has been used to promote and leverage business services and products since the early 90s. Just take a minute to think back to ads presented to you in the 90s and compare it to the most recent ad you have seen today. Are you visualizing any changes and differences?

Digital Marketing: Then And Now

You are definitely not alone. This has happened to many businesses. The most probable cause is that you have become unverified by Google without any notice.

Google reviews disappeared? Here’s what you can do about it.

A <a href="https://www.knoxnews.com/story/news/local/tennessee/2016/12/27/social-media-underused-gatlinburg-firestorm/95442984/" target="_blank">recent article written by the Knoxville News Sentinel</a> makes accusations that the cities of Gatlinburg and Pigeon Forge made no use of social media to warn residents and visitors of the Gatlinburg wildfires. I wanted to chime in and complete this story because most people are unaware of this and just assume that social media is a great way, in today’s time, to communicate with people. First, I will preface by saying that it may not have hurt anything to have posted on social media as a city to the community. But is it really that important they did or did not post to social media? NO! Here are a few reasons why:

Was Social Media Underused During the Gatlinburg Wildfire Events?

At IMEG, we have been working with local government and other organizations to provide services, data and insights to help solve some of the problems problems with housing, communication, PR and marketing. We wanted to share this data with you to help our local businesses and community receive insights on the market.

Sevier County Market Update: December 2016

Both candidates Donald Trump and Hillary Clinton invested millions of dollars into their marketing campaigns throughout the 2016 presidential race. How much of that budget was invested in digital marketing? According to reports by <a href="https://www.bloomberg.com/politics/graphics/2016-presidential-campaign-fundraising/" target="_blank">Bloomberg</a>, Trump’s campaign invested 59 million dollars into digital and Clinton’s campaign invested 17 million. Bringing the difference in budget between the two of 42 million dollars.

Did the 2016 Presidential Campaigns Prove the Importance of Digital vs. Traditional Marketing?

OTAs can grow your business by generating bookings with your brand by driving traffic to their sites like Expedia.com, Orbitz.com, Hotels.com and Booking.com. In return for their booking production, they charge you 15% – 25%. Good or bad deal?

How OTAs Grow Your Business

Data is everywhere, and, most likely, the data that businesses have stored about you have led to your transactions with them. This is not a bad thing, it just means businesses know more about us as consumers and what we value. This leaves less friction B2C and higher conversion rates, growing revenue at an optimal rate. Any business that is focusing on growing revenue is using data on the consumer’s actions online to market to back into their values.

Is Data Being Held Hostage in the Hotel Industry?

Large flag hotels like Holiday Inn and Marriott have been implementing their loyalty programs since the early 1980s, not long after American Airlines launched AAdvantage in 1981. Since the creation of these strategies, these companies have continued to evaluate and refine their approach to produce the best return on investment.

The Future of Points-Based Hotel Loyalty Programs

In late August 2016, Google announced they will lower the ranking of websites using intrusive pop-ups and interstitials starting on January 10, 2017. We have compiled some helpful information for our clients running our SASS Capture. We want to make sure you understand the details and how to handle this.

Google Announces Lowering Website Rankings for Sites Using Intrusive Mobile Pop-Ups

Expedia’s CEO, Dara Khosrowshahi, was interviewed by Bloomberg’s Alex Steel and Scarlet Fu on May 11, 2016 (<a href="https://www.bloomberg.com/news/videos/2016-05-11/expedia-s-ceo-weighs-in-on-the-travel-industry" target="_blank">click here to see full interview</a>). He spoke about the incredible growth his company has seen this quarter at 37% in room nights booked. He went on to talk about how important execution and innovation has been in their growth as a company.

Why Do Travelers Book with Expedia Instead of Booking Direct?

If you are a client of IMEG you have probably heard us say that position 1 is typically not the best for conversion when it comes to paid search. A recent study by Adobe Media Optimizer in February 2016 proves this point by showing that the 4th position on the page produces the best results. According to this study, the cost per click dropped, but the click through rate increased following Google’s removal of the right sidebar ads.

Why the #1 Position on Google is Not Always Best for Conversion

The IBM Watson computer is a cognitive technology that processes information more like a human than a computer. Watson is able take in unstructured data and process it cognitively, then give an answer that has been analyzed through millions of documents.

Benefits of IBM Watson in the Hotel Industry

It’s not always easy to build a successful marketing strategy – even if you know your business inside and out. Successful marketing comes from choosing the right methods to use and tracking your efforts to know exactly what is working for you.

7 Basic Tips for Marketing Your Hotel or Cabin Rental Company

Over the past few years, the term “content marketing” has been used to describe any and all website writing. But, it’s important to know that not all content marketing will directly increase your organic search traffic or your organic rankings. When you implement a content marketing strategy, you can increase your organic search traffic and organic rankings. The key is understanding and implementing the best strategy for your business and writing to target your specific audience.

3 Tips to Help Your Content Marketing Improve Organic Search Traffic

Emotion. A natural instinctive state of mind deriving from one’s circumstances, mood or relationships with others.

When to Use and When Not to Use Emotion in Business

2015 was a year of great success for the Sevier County website, <a href="https://www.visitmysmokies.com/" target="_blank">VisitMySmokies.com</a>. For the first time in the website’s history, it saw nearly 2.5 million visitors in 2015!

VisitMySmokies.com Sets New Record in 2015

On any given night, the population of New Orleans–over 375,000 people–is staying with an Airbnb host.

The Truth About Airbnb and How It’s Shaking Up the Hospitality Industry

2014 was a year of great success for VisitMySmokies.com. For the first time in the site’s history, it saw nearly 2 million visitors in a single year.

VisitMySmokies.com Sets New Traffic Record in 2014

When Justin Jones first founded IMEG in 2009, he knew the only way to be successful was to continuously push his company to learn more and be better.

Innovation Earns IMEG Spot On Inc. Magazine’s Top 500|5000 List

Have you ever planned a vacation to the Smoky Mountains? What about just finding a great place to eat or something fun to do in Pigeon Forge on a warm sunny day? If you answered yes to either of these questions, then you have probably found the website VisitMySmokies.com, and you weren’t alone.

IMEG Announces Record Breaking Year For VisitMySmokies.com

It’s no secret, content marketing is here to stay. You’ve probably seen the webinars, read the articles or witnessed the changes that Google has made over the last few years. To help you understand a little more about <a href="/what-we-do" title="content marketing">content marketing</a>, and why it’s so important, we’ve put together a few things you probably don’t already know.

Top 3 Things You Probably Don’t Know About Content Marketing

Which web page on a company’s site gets the most visitors? If you answered the About Us page, you were right. When users have reached a website they usually visit the about page within three or four clicks. This makes it the most clicked page on websites, yet many companies are not taking advantage of this prime real estate.

Why Your About Us Page is Important

<strong>IMEG Wants To Know Specifically What is it that Clients Want, and how can IMEG meet/exceed expectations ?</strong>

Why you may have chosen IMEG

You undoubtedly know someone who can recommend all of the best restaurants, coolest movies, great places to shop, and even best places to get your hair cut. When you trust that individual, that person can have influence over you. It’s no surprise that there are very influential people in the online world, who may be obscure except for the people who follow them and listen to what they have to say. It should come as no surprise that companies such as Klout have come along, attempting to measure online influence and how it can affect buying behavior.

Got Klout? Influence and how it works.

Calvin Lee is a graphic designer for the city of Los Angeles. He is also one of the most sought-after non-celebrity online personalities for brands in the world. What is it that makes Calvin Lee special? The fact that he tweets up to 200 times a day helps! It’s not just that he tweets, it’s that he tweets everything from celebrity news to articles about graphic design to 80,000 followers, and engages with many of them, and eventually forms friendships offline. His unpaid work has been rewarded. Just a couple of the perks Lee has received included a week-long test-drive of a brand new Audi A8, a pass to the House of Blues VIP event at at the private Las Vegas Foundation Room club, and thousands of dollars in gift cards. Calvin was featured in Mark W. Schaefer’s book Return on Influence.

Who is Calvin Lee and Why Do You Care? Social Influence 101

Social media continues to evolve year after year. Each year there are new social media platforms, new features and tools, and new ways to reach your potential consumers.

Top Social Media Predictions for 2013 from IMEG Social Media Marketing & SEO Expert

<em>Positive results for partners reported 25 days after IMEG takes over Sevier County’s internet marketing campaign Visit My Smokies.</em>

Sevier County internet marketing campaign website www.visitmysmokies.com launching on Nov.1st

Have you lost some Fans beginning September 25, 2012? We at IMEG have been tracking this since September 25, 2012 and for most of our clients it seems Facebook has been cleaning house. We see the greatest fan decline on September 25, 26 and 28 as of today September 30th as you can see from the chart below.

Operation Unlike – Are you losing facebook fans?

<strong>What is a good quality score for Google adwords?</strong>

What is a good quality score for Google adwords?