Hello from your friends at IMEG. The tourism industry accounts for 10% of the world’s GDP and jobs.The World Travel and Tourism Council has warned the COVID-19 pandemic could cut 50 million jobs worldwide in the travel and tourism industry.

The truly difficult part of the current problem is estimating the depth and length of time this problem is likely to persist. It could be weeks or even months. No one knows this answer and your response to this crisis will be dictated by the amount of flexibility you have available.

What is clear is that the government, corporations and financial markets’ responses to the Coronavirus are escalating at a very rapid rate and are likely to continue to become even more aggressive. So, what are some things you can do to help navigate this pandemic and help your business survive now and thrive later?

In this article, I will only talk about 1 thing – the most important thing: CASH!

I will not talk about payroll protection programs, how to lay people off, marketing, when things are expected to turn around or what it looks like when it does. For responses on those issues you are facing, we have started a free podcast where we update almost daily to give the travel and tourism industry advice and help on situations throughout these difficult times. You can find it at: vacationrentalspodcast.com

The most important thing is to focus on cash which is what I refer to as the oxygen of any business. A human can only make it about 1 minute without oxygen before brain cells begin to die and, at 3 minutes, serious brain damage is likely. In business, cash flow is oxygen. Without oxygen, businesses will die, so we have to do all we can to have cash flow for our business.

Cash and cash flow win economic wars. When we need cash flow, we have 3 levers we can pull to get more cash:

- Operating Activities

- Investing Activities

- Financing Activities

Operating Activities

Operating activities are really tough and are limited due to the inability of people to travel and reserve places to stay. However, a target on the wall I believe you should have in your business is: cut expenses faster than revenue. I think it’s a smart time to assess our assets. The assets we should consider cutting are assets that do not produce direct cash flow. Almost everything in your business should be looked at as an asset that produces revenue. Then, that revenue should produce profit and that profit should produce cash. We spend that cash on 1 of 2 things: (1) something that creates more revenue like getting a new guest or (2) keeping an owner or guest.

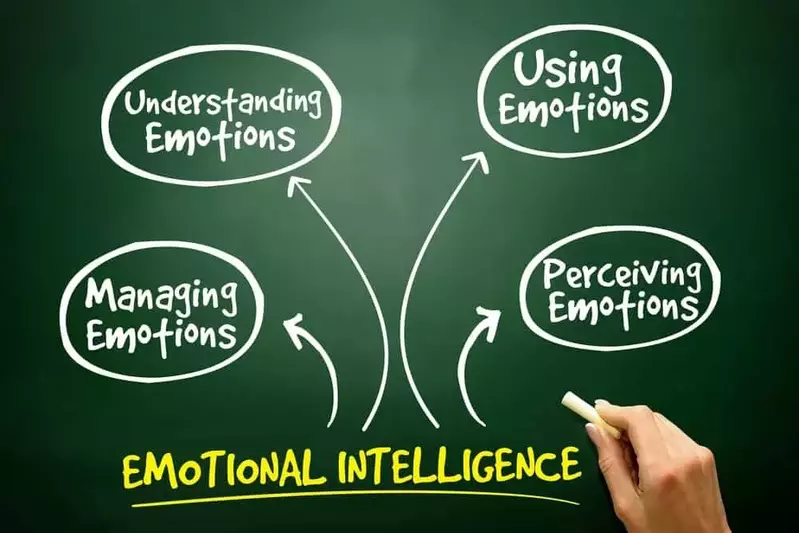

Here is a simple version of the process: if you can cut expenses by $52,000 per month and your gross margins are at 30%, a $52,000 expense cut would yield the ability to absorb a $173,333 revenue cut without losing any profit. Remember, we can’t pay bills with revenue – we can only pay bills with cash. DO NOT CUT assets that produce cash. As Warren Buffet says, “if you cannot control your emotions, you cannot control your money.”

Investing Activities

Investing activities are an option for some. We could sell any assets that have equity, find business investors to invest in us, etc., but these all take time that we may not have.

Financing Activities

The last type of cash is financing cash and this type comes from financing activities. This one is typically straightforward and, in short, you go get loans from banks or hard money lenders to inject cash into your business. Now, we have options like the Payroll Protection Program (PPP) which is a forgivable loan if used directly on approved expenses, the Economic Injury Disaster Loan (EIDL) and Loan Advance which is a low-interest option to help with cash flow.

This article was written by Justin Jones – Founder of IMEG. Many travel and tourism businesses find online marketing complicated. At IMEG, we simplify the process to help grow their businesses.