On any given night, the population of New Orleans–over 375,000 people–is staying with an Airbnb host.

For those of you who have no clue about Airbnb, here is a quick overview:

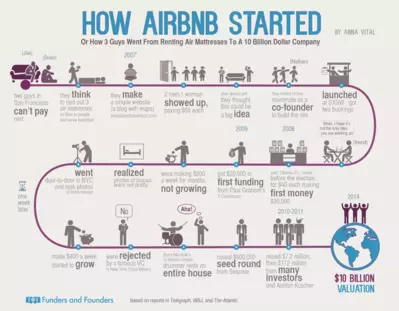

In 2008, some young guys who lived in San Francisco weren’t sure how to pay rent, so they had an idea to rent some rooms in their place to people who were coming to a large design conference in San Francisco–accommodations were scarce. They bought some air mattresses, set them up in extra space and rooms in their condo, created a basic website and told a few people about it. Then, they added the element to serve breakfast to their guests also. And there you have it–Air Mattress Bed and Breakfast. Silly, huh? Silly or not, they are now valued at over 10 BILLION dollars with a market cap of 20 BILLION dollars. Yes, that is billion with a B.

What is Airbnb?

Airbnb is an online community marketplace that connects people looking to rent their homes with people who are looking for accommodations. Airbnb users include hosts and travelers: hosts list and rent out their unused spaces and travelers search for and book accommodations in 192 countries worldwide.

How large is Airbnb?

Interesting Facts:

- 600+ homes are shared all over the world

- 192 countries

- Airbnb guests stay longer than average travelers (average travelers stay for 2.8 nights while Airbnb’s average is 5 nights).

- About 20% of people staying with Airbnb are staying more than 30 days or more.

- Airbnb guests spend more per trip with an average of $978 per trip while the typical traveler averages $669 per trip.

- Less than 20% of people have heard of Airbnb and the sharing economy so they have much more room to grow.

- Partnership with Concur to solidify business travel

- Hotels list on Airbnb

Impact of Airbnb on the Hospitality Industry

A recent report from Boston University shows a 10% increase in Airbnb supply results in a .35% impact on revenue in Austin, Texas. Read the full study here: https://people.bu.edu/zg/publications/Airbnb.pdf.

We feel that Airbnb is really just getting started and has so much more room to grow; it will have a major impact on the hospitality industry. Warren Buffett, the not so tech billionaire, recently told attendees looking for hotel rooms for the Berkshire Hathaway annual meeting to not be discouraged by limited hotel rooms and to choose Airbnb. I do not feel Airbnb is creating much more demand, they are simply shifting it to another form and driving the price down for consumers and revenue for the industry–the same way Uber is for transportation. As a result, research shows that the traditional lodging market is lowering its rates in an effort to stay competitive.

What do the major players in the hospitality space think of Airbnb?

CEO of Marriott International, Arne Sorenson, stated on CBS that Airbnb was an interesting experiment and he did not see them as any threat.

The Core Downside to Airbnb and the Sharing Economy

Cities and states both tax and regulate the lodging industry, and the people who stay in hotels are usually a vital source of tax revenue. Most of Airbnb’s customers are not paying taxes required under the law. So local, and state governments are losing tax revenue.

Thoughts: The Future of Airbnb

I think Airbnb is highly overlooked by hotels and the major players in the vacation rental industry, like HomeAway for example. Airbnb is growing rapidly in all areas, but I think the overlooked area is that they are way more than hosts renting out extra rooms in their homes to make some extra money. You can rent entire homes, castles, boats, hotel rooms, tents and everything in between. Example: In Las Vegas, Airbnb has over 1,000 rentals: 760 entire homes, 373 private rooms and 26 shared rooms. So to think this is a website where people are simply renting out extra rooms is delusional.

Airbnb is a threat to HomeAway. Homeway seems to deny this, but the facts show otherwise. Airbnb is threat to the entire hospitality industry. Another thing I think is extremely overlooked is Airbnb bringing Chip Conley on to the team as Head of Global Hospitality and Strategy. I am a big Chip Conley fan and think someone like him was the missing link for Airbnb to truly be a major, long term player. Chip is taking Airbnb from a technology company and making them a true hospitality company.

What Airbnb Says About Tax

Which local taxes apply to my listing and how do I collect them?

Your state or locality may impose a tax on the rental of rooms. In many places, this is known as an occupancy tax, but may also be known as a room tax, use tax, tourist tax or hotel tax.

Hosts who determine they need to collect such a tax may either incorporate it into their nightly price, add it via a special offer or ask their guests to pay it in person. In each case, it’s important that guests are informed of the exact tax amount prior to booking.

In some locations, Airbnb has made agreements with government officials to collect and remit local taxes on your behalf. This doesn’t change which taxes are due, but it does simplify and automate the process for Airbnb reservations. If your listing is in one of these areas, Airbnb will calculate the tax, charge the guest and remit the tax on your behalf.

Currently, Airbnb is collecting and remitting taxes in the following locations: Multnomah County and Portland, Oregon USA

Guests who book Airbnb listings that are located in the State of Oregon, Multnomah County and/or the City of Portland will pay the following taxes as part of their reservation:

- Oregon Transient Lodging Tax: 1% of the listing price including any cleaning fee for reservations 30 nights and shorter. 1% is the State imposed tax rate only.

- Multnomah County Transient Lodging Tax: 11.5% of the listing price including any cleaning fee for reservations 30 nights and shorter. 11.5% is the maximum Transient Lodging Tax for listings in Multnomah County (excluding the State level tax). For example, for Portland listings that are also located in Multnomah County, the Portland Transient Lodging Tax is 6% and the Multnomah County Transient Lodging Tax is 5.5%.

- Portland Transient Lodging Tax: 6% of the listing price including any cleaning fee for reservations 30 nights and shorter.

San Francisco, CA USA

Guests who book Airbnb listings that are located in San Francisco, CA will pay the following taxes as part of their reservation:

- San Francisco Transient Occupancy Tax: 14% of the listing price including any cleaning fee for reservations 29 nights and shorter. 14% is the tax rate imposed by the City and County of San Francisco (the tax jurisdictions are one and the same).

Amsterdam, NL

Starting February 1, 2015, guests who book Airbnb listings that are located in the City of Amsterdam, NL will pay the following taxes as part of their reservation:

- Amsterdam Tourist Tax: 5% of the listing price including any cleaning fee. 5% is the tax rate imposed by the City of Amsterdam as of 1/1/2015.

San Jose, CA USA

Starting February 1, 2015, guests who book Airbnb listings that are located in San Jose, CA will pay the following taxes as part of their reservation:

- San Jose Transient Occupancy Tax: 10% of the listing price including any cleaning fee for reservations 30 nights and shorter.

Chicago, IL USA

Starting February 15, 2015, guests who book Airbnb listings that are located in Chicago, IL will pay the following taxes as part of their reservation:

- Chicago Hotel Accommodation Tax: 4.5% of the listing price including any cleaning fee for reservations 29 nights and shorter.

District of Columbia, USA

Starting February 15, 2015, guests who book Airbnb listings that are located in the District of Columbia will pay the following taxes as part of their reservation:

- DC Sales Tax on Hotels (transient accommodations): 14.5% of the listing price including any cleaning fee for reservations 90 nights and shorter.

Hosts located in these areas are responsible for assessing all other tax obligations, including state and city jurisdictions.

For more information about how Airbnb taxes work, go here: https://www.airbnb.co.in/help.

Final Thoughts: What do I think about Airbnb?

I have used Airbnb as a renter and have listed a property as well. Do I pay all taxes I should on the property I have listed? YES! Do most? NO! I think the sharing economy is a good thing, but like all things, it does have downsides. I do think an Airbnb host should have to abide by the same laws and standards as any hotel or any other lodging company. The playing field should be the same for everyone in the hospitality industry and, in my opinion, the sharing economy applies. The sharing economy in the hospitality industry is here to stay and not going away, so watch Airbnb and others in the hospitality sharing economy to grow and shake up the market.

Questions or comments about this blog? Email the author [email protected] – Justin Jones CEO / Founder IMEG